Security tokens are considered as the next big thing within the financial sector. Replacing all existing systems, stakeholders and beneficiaries. Let me explain why the technology is overhyped.

Security tokens came out as a result of classical ICOs launching their utility token (a unit that e.g. serves as a matter of payment or exchange and a native currency within an application) massively failed to deliver the promised results or turned out to be an obvious scam. Hence, people wanted to go back to the far more regulated space of securities – meaning: Being officially considered as securities by the regulator and complying with the respective laws that are apparently much stricter than they are for utility tokens.

However, security tokens seem to be better comparable to securities than to utility tokens. And that makes the comparison very different.

Classical securities vs. tokenized securities

Focusing on a comparison because securities from the classical financial system (e.g. banks and stock exchanges) on tokenized securities, you can outline the following main advantages of security tokens:

- a lightweight process of issuance

- one decentralized network they are deployed on

- faster interinstitutional settlement

- higher scalability due to independence from specific regulations

- always available network: no closing times of trading

However, leveraging the advantages will not be possible without many intermediaries serving the system such as secondary markets (as we know them from the stock market), issuing parties (as we know them from banks) and further.

Hence, there are many advantages tokenized securities have, but removing all intermediaries from the issuance and trading process will be impossible.

— Make sure to register for my newsletter to receive information earlier and exclusive newsletter content. No spam, you can unsubscribe at any time. —

Why tokenized securities are overhyped

As we have seen, the advantages mentioned above are of a technical nature. They enable startups and enterprises to raise money in a better way. So the projects that would be successful by raising capital through the classical path can be more successful by choosing tokenized securities. However, simply using security tokens will not make a startup successful – it is only the technology behind and not their core business.

Considering the expressions of many experts, funds, and people in and without the Blockchain space, they want to invest in security tokens. A fund that was founded to fund Blockchain projects switching to all sorts of security tokens completely loses the focus since it is no longer concentrated on Blockchain products, but any product with a Blockchain based funding method.

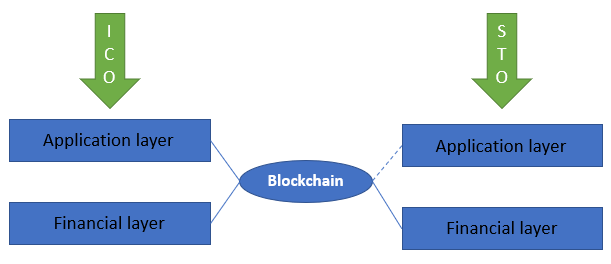

Simply speaking, while an ICO needs the Blockchain both for their application and their funding, an STO needs it for the funding and CAN use it for the application. Betting on the success of Blockchain startups and shooting on STOs is like saying you invest in financial companies when you buy stocks of a shoe brand at the stock market.

This is not a legal or financial advice. Make sure to register for my newsletter to receive information earlier and exclusive newsletter content. No spam, you can ubsubscribe at any time.