Most of the ICOs are focused on innovative concepts, dominantly in technological ways. What is the difference that makes an ICO to a gamechanger in the market or leaves it as a small, incremental innovation in the competitive surrounding?

The innovation matrix

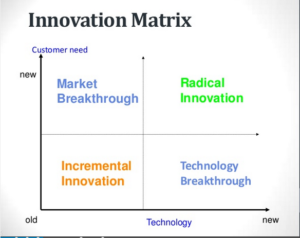

A concept that has been developed before the existence of ICOs is the innovation matrix. The matrix allows to classify innovations in their expected effect. It is used by managers to evaluate technological innovations.

Since we are often dealing with technological innovations by ICOs, the can be facilitated to classify ICOs as well. Let’s have a look at the matrix.

It covers two dimensions:

1. Customer need

Is the customer need already existing, or should this innovation create a new market, capturing new customer needs?

2. Technology

Is the technology really innovative or characterized by old-fashioned ways of solving the problem?

If you neither have a new technology, nor a new customer need, the innovation is incremental, limited in its effect and breakthrough. On the other hand, if you advance in one of the dimensions, so you either have a new technology or you fulfil a new customer need, this innovation can be a breakthrough – technologically or on the market. Combining both a new customer need as well as a new technology, it allows for a radical innovation, a gamechanging project.

How to find gamechanging ICOs

It is not possible to objectively evaluate the different types of innovations concerning their future success on the market being better or worse. It highly depends on the context you are looking at it. If you are an investor, you inherit your own risk profile.

Are you looking for a project that refers to proven concepts and feasible solutions, but is limited in its overall effect on the industry since it is rather an incremental innovation? Or are you rather looking for a gamechanging project that tries to enter – or “create” – a new market and could promise you a radical breakthrough? These are questions of your investors profile that need to be answered individually.

Although, in this post we are discussing the main idea of radical innovation in ICOs.

As you already know, you need both a new technology, as well as a new customer need, to reach a radical innovation. Therefore, have a look at the project from different angles.

The customers angle

Ask yourself: Is there a solution on the market that addresses the same problem? Is there a USP of this solution against existing ones?

Although these questions may seem quite obvious, try to focus just on these two basics. It allows you to see the project from the isolated perspective of a customer. As a customer, you want your problem to be solved – in the most effective and efficient way. You usually don’t care about the technological stack behind it. What matters is the result, the real solution.

The technology perspective

Does the project use a technology that offers new possibilities by its conception? Is it relevant for the solution this innovation promises to offer? This highly refers to the first angle of the customer, focusing on the actual outcome and not on the technology stack behind it. Here, we can compare the solution to competitors. Does the project have an advantage to a similar project that facilitates a different technology?

Decentralization is a promising concept, though it does not always offer significant benefits compared to centralized solutions. If the project focuses on building a decentralized solution that already exists in a centralized version on the market, the technological advantage or USP is relatively low.

Answer these questions with yes or no.

Only if you can answer the questions of both dimensions with “yes”, you are heading for a possible radical innovation.

The ICO hype and its real value: Non-backed value increases?

As stated above, the choice between different types of innovation is a personal one. Nevertheless, I want to share a few thoughts with you about the current market of ICOs and its relation to types of innovation.

Apparently, the volumes ICOs are raising in the tokensale period, as well as the market capitalization after the token issuance are reaching very high levels, often high multimillion dollar figures or even a billion. Both the absolute figures and the relative increase of value of many ICO tokens brought up huge critics about ICOs being a speculative object without real values created behind. In fact, I believe that massive innovations are necessary to really create the value that the market capitalizations of many projects inherit.

It is not correct to say that incremental innovations could never be successful. Still, to reach a multiplicative increase of token values that is backed by real created value, a radical innovation is necessary. If you are looking for rapidly growing, but rather risky projects, radical innovations could be the type of innovation to look at. If you are looking for a more stable environment in an existing market, a technological or a market breakthrough may be better than a radical innovation. BUT: Set your expectations according to your strategy. Simply following the basic economic assumption of taking a higher risk leads to higher possible revenues, you may be warned if a project is overhyped.

Image source (Innovation matrix): Sheryl Satorre

The above references an opinion and is for information purposes only. No financial advice.